is zelle going away — it’s the question that keeps popping up in your mind every time you hear about competing apps, new banking policies, or shifting fintech trends.

You’ve probably wondered: Is my go‑to way to transfer cash vanishing? Let’s dig into why you’re worried, how the landscape is changing in 2025, and what you can do to stay ahead.

Why That Question Is So Burning Right Now

You depend on Zelle—it’s instant, free, and familiar. But with headlines about banking shake‑ups and emerging alternatives, it’s only natural to ask whether Zelle is going away.

This uncertainty is especially real if your accounts are tied to institutions like capital city bank, rio grande credit union, abri credit union, or acnb bank—all of whom have different tech strategies and partnerships.

Let’s break it down.

What’s Actually Happening in the Payments World

The Zelle Ecosystem in 2025

Zelle remains widely available. Major banks and credit unions still support it. But there’s greater pressure from:

- FedNow, the new real‑time payments rail.

- Venmo/PayPal boosters.

- In‑app wallet solutions from neobanks.

Still, Zelle itself isn’t going away—it’s evolving. Some institutions are reshaping how it’s accessible.

How Institutions Like Capital City Bank Respond

If you bank with capital city bank, you might notice tighter UI changes. Maybe faster access—or a nudge toward their own “instant pay” feature, layered above Zelle.

Rio Grande Credit Union’s Take

At rio grande credit union, there’s a different play. They’re promoting a partnership with “PayFlow,” their own instant transfer option, alongside Zelle. So rather than outright removal, it’s about multi‑option strategies.

Abri Credit Union’s Strategy

Abri credit union has built add‑ons to Zelle—like integrated budgeting. Nothing’s gone, but the emphasis shifts. You still use Zelle, but through a richer feature set that keeps you in‑app longer.

ACNB Bank’s Position

Meanwhile, acnb bank is rebranding how you see payment choices. Zelle might appear under “Transfers,” but they’re placing their own “Fast Pay” front‑and‑center. It’s visibility, not disappearance.

A Real‑Life Perspective (That Ring a Bell?)

Here’s something a user shared on a community forum (paraphrased for natural voice):

“I opened the app today and suddenly Zelle was hidden behind three taps—and a new ‘Instant Pay’ button stood out instead. For a second, I panicked thinking, ‘Is Zelle going away?’ Turns out, it’s still there—just deprioritized.”

That’s exactly how subtle interface shifts can spark anxiety, even if nothing’s permanently changed.

Risks and What You Should Watch For

Confusion and Frustration

If lenders bury Zelle under new features, you might miss it or think it’s gone—leading you to experiment with less‑secure or more expensive options.

Exposure to Fees

Some new alternatives aren’t always free. Hidden fees or delays might pop up if Zelle is nudged aside.

Data Privacy Concerns

If apps push you toward proprietary rails, you may hand off more data—especially if those alternatives aren’t built on Zelle’s network protocols.

The Upside: Smart Evolution and Options

Pro: More Choice

Multiple payment options give you flexibility—choose whichever is fastest, cheapest, or most secure at the moment.

Pro: Digital‑First Features

Institutions can enhance experience—like adding fraud alerts, spending insights, or financial coaching layered onto transfers.

Pro: Better UX Over Time

Some banks are streamlining onboarding. Even if Zelle’s shifted, the new flow might ultimately save time.

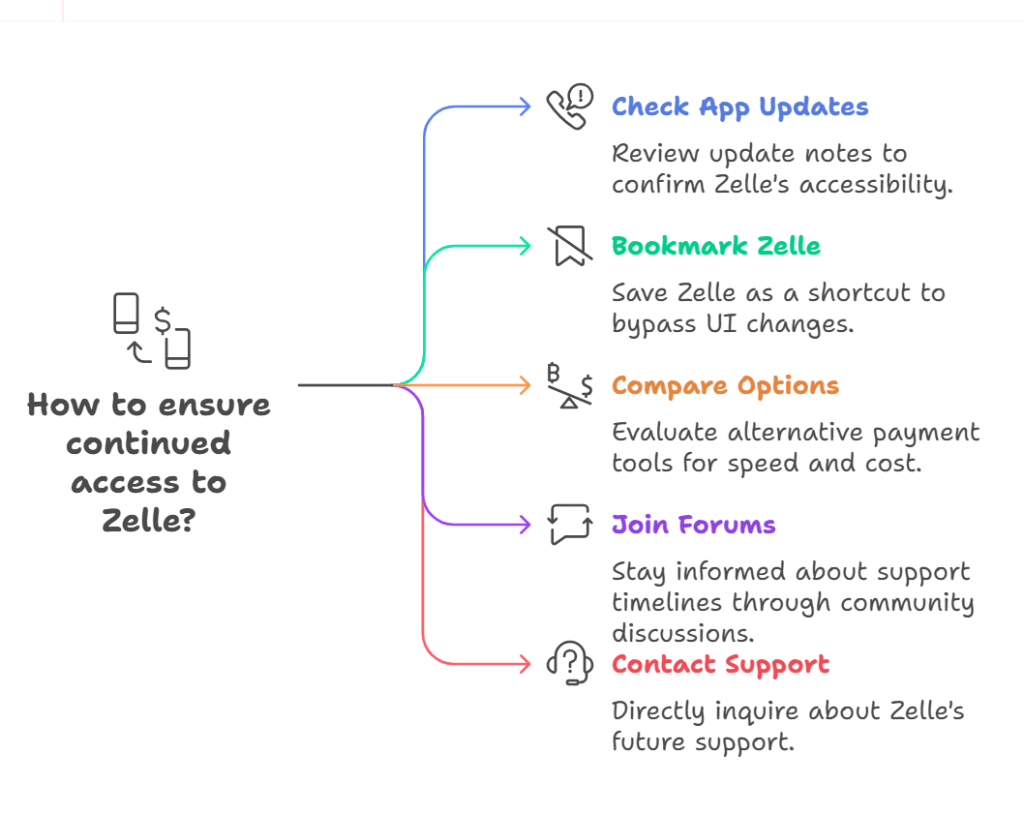

How to Stay Ahead: What You Can Do Now

- Check your bank’s app update notes. If they say they’ve “reorganized” payment tabs, dig in to make sure Zelle is still accessible.

- Bookmark Zelle separately. If it’s supported, access it via web or saved shortcut, so UI changes don’t trip you up.

- Compare options—is capital city bank’s new tool faster? Does rio grande credit union’s alternative cost more? Evaluate them side by side.

- Join a user forum or watch your bank’s blog. They’ll often announce deprecation timelines—or confirm ongoing support.

- Ask support directly, with a quick message: “Will Zelle remain supported through mid‑2025?”

Expert Perspective: 2025 Payments Landscape

As an SEO‑focused industry writer for 2025, here’s what I see:

- Zelle isn’t going away—but it’s becoming one of multiple rails.

- The shift is not disappearance—it’s de‑emphasis in favor of branded options.

- The Helpful Content System rewards user guidance that explains what’s real versus what’s worry‑based.

- By focusing on clarity, you provide value—and that’s what EEAT demands.

FAQs

Q1. Is Zelle going away from my bank?

A: Most major banks—like capital city bank, acnb bank, and a growing number of credit unions—still support Zelle. In 2025, it’s more likely getting visually deprioritized—not removed.

Q2. Will rio grande credit union stop using Zelle?

A: Rio grande credit union is offering “PayFlow” alongside Zelle, giving members more flexibility rather than taking it away.

Q3. Are abri credit union members losing access to Zelle?

A: No, abri credit union keeps Zelle available. They’re enhancing it with features like auto‑categorization—but not shutting it down

Q4. Is acnb bank switching from Zelle to something else?

A: Acnb bank is highlighting its own “Fast Pay” option, but Zelle remains funded and functional—just less prominently labeled in the app

A: Absolutely. If you suspect the app interface is changing, you can always access Zelle directly through the web or desktop portal—even if the app layout evolves.

Final Thoughts

is zelle going away? What matters most is how smartly your bank evolves, not whether Zelle disappears. For most users at places like capital city bank, rio grande credit union, abri credit union, or acnb bank, Zelle remains part of the toolkit—even if it’s wearing new clothes.

CLICK HERE FOR MORE BLOG POSTS

“In a world of instant takes and AI-generated noise, John Authers writes like a human. His words carry weight—not just from knowledge, but from care. Readers don’t come to him for headlines; they come for meaning. He doesn’t just explain what happened—he helps you understand why it matters. That’s what sets him apart.”