What Does an Audit Program Look Like? in today’s fast-changing business world?” If you’re responsible for compliance, risk management, or financial oversight, you’ve probably faced the challenge of designing or understanding an audit program that actually works. Maybe you’re auditing a fraternal organization, or you’re just trying to build a bulletproof audit checklist for your team. Either way, you’re not alone—many professionals are searching for clear, actionable answers.

In this comprehensive guide, we’ll break down exactly what an audit program looks like in 2025, how to tailor it for different organizations, and why a well-structured audit program is more important than ever. We’ll also share real-world examples, expert tips, and a practical FAQ to help you audit the audit process with confidence.

What Does an Audit Program Look Like? (The Big Picture)

At its core, an audit program is a detailed plan that outlines the steps, procedures, and objectives for conducting an audit. Think of it as a roadmap for auditors, guiding them from start to finish. But what does an audit program look like in practice? It’s more than just a checklist—it’s a living document that adapts to your organization’s needs, risks, and regulatory requirements.

A modern audit program typically includes:

- Objectives: What are you trying to achieve?

- Scope: What areas, departments, or processes will be audited?

- Methodology: How will you gather and evaluate evidence?

- Audit Checklist: What specific steps will auditors follow?

- Resources: Who will be involved, and what tools will they use?

- Timeline: When will each phase of the audit take place?

- Reporting: How will findings be documented and communicated?

Let’s dig deeper into each of these elements and see how they come together in a real-world audit program.

The Anatomy of an Audit Program: Key Components

Objectives: Setting the Stage

Every audit program starts with clear objectives. Are you looking to ensure financial accuracy, test internal controls, or assess compliance with regulations? Defining your goals upfront helps focus the audit and ensures everyone is on the same page.

Scope: Defining What’s In and Out

The scope answers the question: What will the audit cover? For example, if you’re auditing a fraternal organization, your scope might include membership records, financial transactions, and compliance with bylaws. A well-defined scope prevents “audit creep” and keeps the process manageable.

Methodology: How Will You Audit?

This section details the approach auditors will use. Will you conduct interviews, review documents, or test transactions? The methodology should align with your objectives and the risks identified during planning.

Audit Checklist: The Step-by-Step Guide

An audit checklist is the backbone of any audit program. It breaks down the process into actionable steps, ensuring nothing is overlooked. For a financial audit checklist, this might include verifying bank reconciliations, reviewing expense reports, and testing revenue recognition.

Resources: Who and What

List the team members, tools, and technologies needed for the audit. In 2025, this often includes data analytics software, secure file-sharing platforms, and even AI-powered risk assessment tools.

Timeline: Keeping on Track

A detailed timeline helps keep the audit on schedule. It should include milestones for planning, fieldwork, reporting, and follow-up.

Reporting: Communicating Results

Finally, the audit program should outline how findings will be reported. Will you use a formal report, a dashboard, or a presentation to management? Clear communication is key to driving action on audit recommendations.

Real-World Example: Auditing a Fraternal Organization

Let’s say you’re auditing a fraternal organization—a common scenario for volunteer treasurers and nonprofit boards. Here’s what an audit program might look like:

- Objective: Ensure financial transparency and compliance with bylaws.

- Scope: Review all financial transactions, membership dues, and expense reimbursements for the past year.

- Methodology: Examine bank statements, cross-check receipts, and interview officers.

- Audit Checklist:

- Verify all deposits match membership records

- Review expense approvals

- Confirm compliance with spending limits

- Test a sample of transactions for accuracy

- Resources: Two volunteer auditors, access to accounting software, and secure cloud storage.

- Timeline: Two weeks for fieldwork, one week for reporting.

- Reporting: Present findings at the next board meeting and provide a written summary.

A user recently shared, “Our annual audit used to be a headache, but with a clear audit checklist and timeline, we finished early and found ways to improve our processes.”

Why Audit Programs Matter More Than Ever in 2025

With increasing regulatory scrutiny, cyber risks, and stakeholder expectations, a robust audit program isn’t just a best practice—it’s a necessity. In 2025, organizations face new challenges:

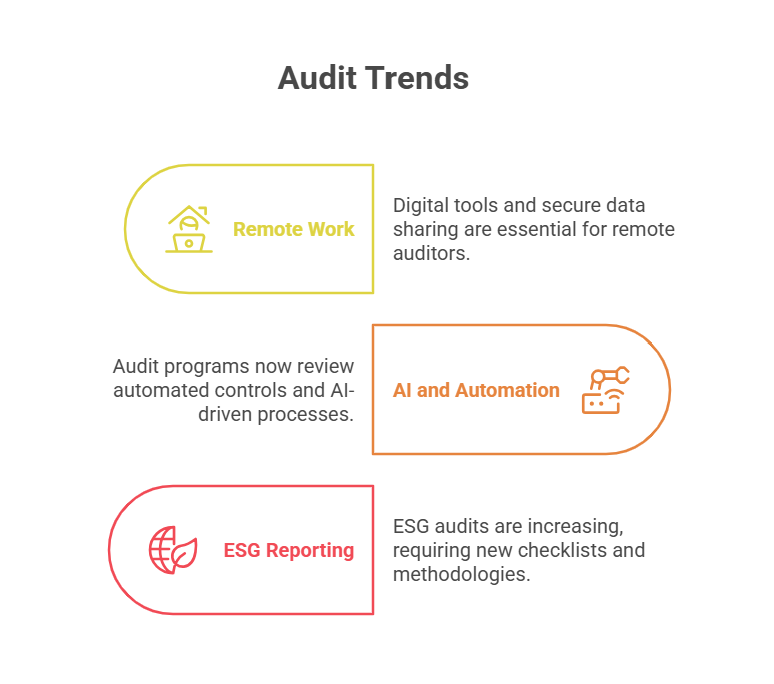

- Remote Work: Auditors often work remotely, making digital tools and secure data sharing essential.

- AI and Automation: Many audit programs now include steps for reviewing automated controls and AI-driven processes.

- ESG Reporting: Environmental, social, and governance (ESG) audits are on the rise, requiring new checklists and methodologies.

A well-designed audit program helps organizations stay compliant, manage risks, and build trust with stakeholders.

Building an Effective Audit Checklist

A great audit checklist is clear, concise, and tailored to your objectives. Here’s how to build one:

- Start with the End in Mind: What are the key risks or areas of concern?

- Break Down the Process: List each step, from document review to interviews.

- Assign Responsibilities: Who will complete each task?

- Include Evidence Requirements: What documentation is needed to support findings?

- Review and Update Regularly: Audit checklists should evolve as risks and regulations change.

For example, a financial audit checklist might include:

- Confirm all bank accounts are reconciled monthly

- Review supporting documents for all expenses over $500

- Test a sample of revenue transactions for proper recording

- Verify compliance with internal approval policies

Audit the Audit Process: Continuous Improvement

One of the most overlooked aspects of auditing is the need to audit the audit process itself. This means regularly reviewing your audit program to ensure it’s effective, efficient, and up-to-date.

Ask yourself:

- Are our objectives still relevant?

- Is our methodology aligned with current risks?

- Are we using the best tools and technologies?

- Do our audit checklists reflect new regulations or business changes?

By auditing your own process, you can identify gaps, streamline workflows, and deliver more value to your organization.

Financial Audit Checklist: What’s New in 2025?

Financial audits have always been a cornerstone of good governance. But in 2025, the financial audit checklist has evolved to address new risks and opportunities:

- Digital Transactions: Review of cryptocurrency and digital wallet activity.

- AI-Driven Accounting: Testing the accuracy of automated journal entries.

- Cybersecurity Controls: Verifying protection of financial data.

- ESG Disclosures: Ensuring accurate reporting of environmental and social metrics.

A modern financial audit checklist might look like this:

- Review all digital payment platforms for unauthorized transactions

- Test AI-generated entries for accuracy and completeness

- Confirm cybersecurity protocols for financial systems

- Validate ESG data against source documents

- Assess compliance with new tax regulations

Auditing a Fraternal Organization: Special Considerations

Fraternal organizations, clubs, and nonprofits face unique audit challenges. Here’s what to keep in mind:

- Volunteer Staff: Training may be needed for those unfamiliar with audit processes.

- Limited Resources: Focus on high-risk areas to maximize impact.

- Bylaw Compliance: Ensure all financial activities align with organizational rules.

- Transparency: Clear reporting builds trust with members and donors.

A tailored audit program for a fraternal organization should include a simple, easy-to-follow audit checklist and clear communication of findings.

The Role of Technology in Modern Audit Programs

In 2025, technology is transforming how audits are planned, executed, and reported. Key trends include:

- Cloud-Based Audit Management: Secure, real-time collaboration for remote teams.

- Data Analytics: Automated analysis of large datasets to identify anomalies.

- AI-Powered Risk Assessment: Machine learning tools that flag unusual transactions.

- Digital Evidence Collection: Secure portals for uploading and reviewing documents.

These tools make audits faster, more accurate, and more insightful—if you know how to use them effectively.

Pros and Cons of a Structured Audit Program

Pros

- Consistency: Ensures all audits follow a standard process.

- Efficiency: Saves time by providing clear steps and responsibilities.

- Risk Management: Helps identify and address key risks.

- Accountability: Documents who did what, when, and why.

Cons

- Rigidity: Overly strict programs can stifle flexibility.

- Resource Intensive: Developing and maintaining audit programs takes time.

- Change Management: Staff may resist new processes or technologies.

The key is to balance structure with adaptability, updating your audit program as your organization evolves.

Features of a High-Impact Audit Program in 2025

- Customizable Templates: Adapt to different departments or organizations.

- Integrated Checklists: Link tasks to evidence and responsible parties.

- Automated Alerts: Remind auditors of deadlines and missing information.

- Real-Time Dashboards: Visualize progress and findings instantly.

- Secure Data Storage: Protect sensitive information with encryption and access controls.

These features help organizations audit the audit process and drive continuous improvement.

Real-Life Example: Transforming Audit Programs with Technology

A mid-sized nonprofit recently revamped its audit program using cloud-based tools and AI-powered checklists. The finance director shared, “We cut our audit time in half and caught issues we’d missed for years. The new system even helped us train volunteers with no prior audit experience.”

This story highlights how modern audit programs can boost efficiency, accuracy, and team confidence.

FAQs

Q What does an audit program look like for a small business?

A. small business audit program is usually a concise document outlining objectives, scope, methodology, and a simple audit checklist. It focuses on key risks like cash handling, expense approvals, and compliance with tax laws.

Q. How do you audit the audit process?

A. audit the audit process, review your audit program regularly. Check if objectives are still relevant, methodologies are effective, and checklists reflect current risks. Use feedback from auditors and stakeholders to make improvements.

Q. What should be included in a financial audit checklist?

A. financial audit checklist should cover bank reconciliations, expense verification, revenue testing, compliance with approval policies, and review of digital transactions. In 2025, it should also address cybersecurity and AI-driven accounting.

Q. What are the unique challenges of auditing a fraternal organization?

A. Challenges include limited resources, volunteer staff, and the need for bylaw compliance. Focus on transparency, clear communication, and a tailored audit checklist to address these issues.

Final Thoughts

So, what does an audit program look like in 2025? It’s a dynamic, tech-enabled roadmap that guides your team through every step of the audit process. Whether you’re auditing a fraternal organization, running a financial audit, or just trying to improve your internal controls, a well-designed audit program is your best tool for success.

testCLICK HERE FOR MORE BLOG POSTS

“In a world of instant takes and AI-generated noise, John Authers writes like a human. His words carry weight—not just from knowledge, but from care. Readers don’t come to him for headlines; they come for meaning. He doesn’t just explain what happened—he helps you understand why it matters. That’s what sets him apart.”